The sudden outbreak of the novel coronavirus has triggered widespread panic buying, with citizens lining up at stores for protective equipment and essential products. While shopping malls and restaurants struggle, health care chains and supermarkets are experiencing a surge in sales. Within a month, Hong Kong’s nascent online shopping culture has rapidly evolved into a daily necessity for netizens. This shift towards “big-time eCommerce” is now distinguishing brand groups and helping consumers identify which promotional efforts best address their needs.

The Evolution of Consumer Behaviour

Compared to the panic buying during the 2003 SARS outbreak, Hong Kong residents are no longer relying on unproven folk remedies. Instead, they’re queuing for surgical masks, hand sanitizers, food, and even toilet paper. Since late January, despite significant sales boosts from panic buying, insufficient stock to alleviate public fears has led most brands to a dilemma, with related buzz volumes soaring.

Social Media Monitoring Reveals Brand Performance

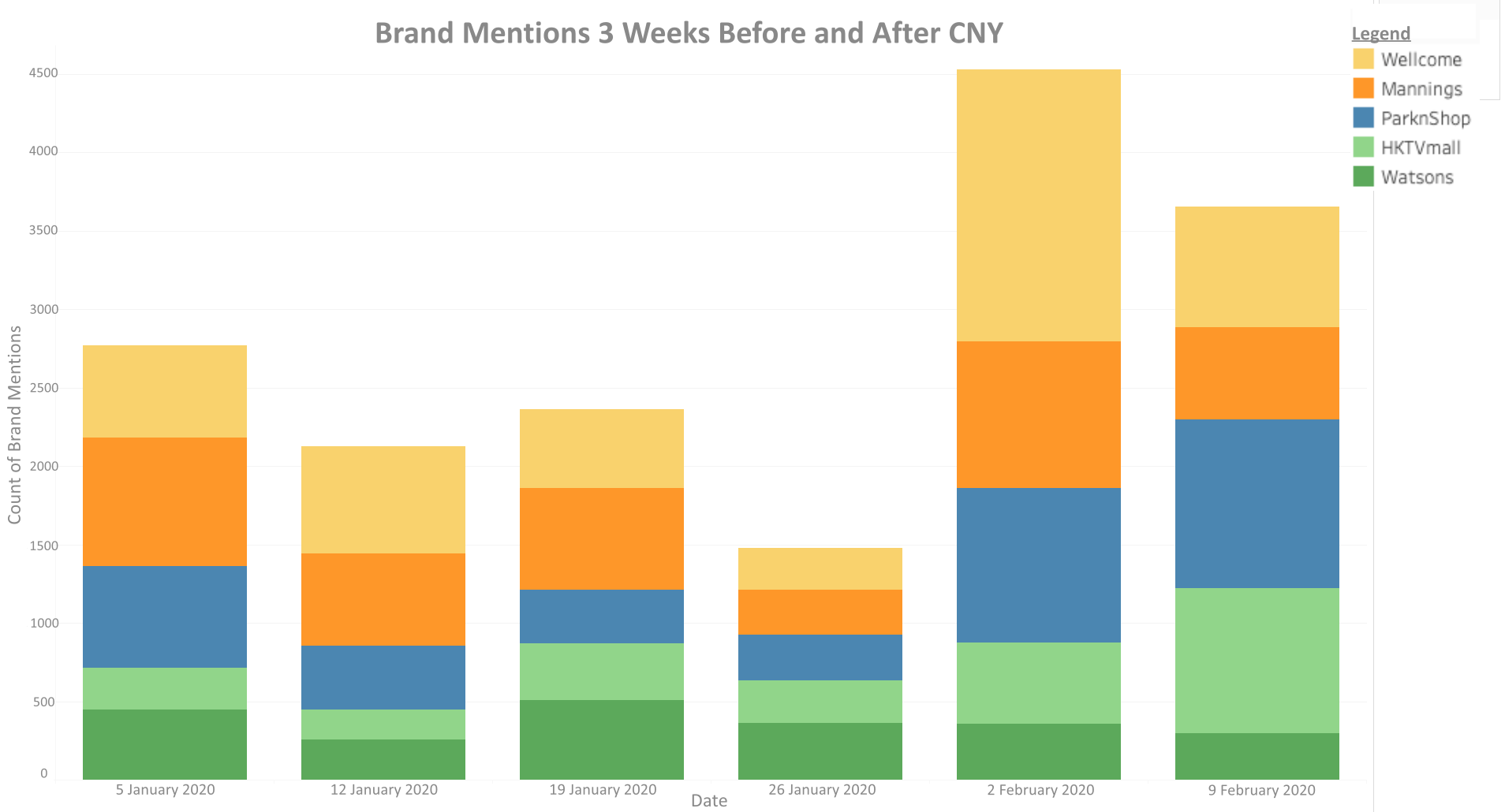

Using social media monitoring tools, we can observe changes in brand mentions before and after the Chinese New Year period:

- Wellcome and ParknShop, two leading supermarket chains, saw notable increases in online mentions after CNY, particularly in the week of February 2, due to rumors about toilet paper supplies.

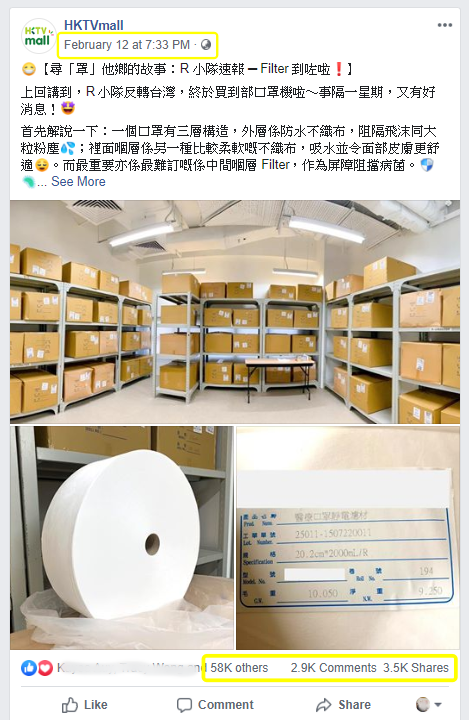

- HKTVmall experienced increased brand mentions post-CNY, with netizens discussing the brand’s efforts to source protective products. Their announcement on February 8 about manufacturing surgical masks independently received significant praise.

Changes of Brand Mentions after Chinese New Year

According to the above chart presented by Tocanan, changes are observed between pre-Chinese lunar new year (by week of Jan 19) and post-Chinese lunar new year (since week of Jan 26) periods:

- Online mentions of Wellcome (yellow) and ParknShop (blue) recorded evident increase after CNY. The Mention boosts of two leading supermarket chains, in the week of Feb 2, were both related to the panic buying after the rumour about toilet paper supplies circulated.

- Brand mention of the HKTVmall (light green) increased after CNY; netizens discussion were mainly about the brand’s dedication to sourcing protective products. Especially on 8th February, HKTVmall’s announcement of independent manufacture of surgical masks received praises from netizens.

Supermarket Chains Struggle with eCommerce Transition

Despite the clear benefits of pivoting from brick-and-mortar to eCommerce during the epidemic, leading brands ParknShop and Wellcome seemed reluctant to fully embrace this shift.

ParknShop initially attracted attention by selling surgical masks and hand sanitizers online. However, netizens complained about the online shop’s inability to handle the surge in demand, resulting in hours-long waits. Wellcome faced similar issues with their online mask sales.

Slider order (from left to right): Wellcome, Mannings, ParknShop, Watsons. Wellcome and Mannings do not address public needs of protective equipment during the epidemic. In contrast, the relevancy in online marketing of ParknShop and Watsons is higher.

HKTVmall Builds an Inclusive Online Community

HKTVmall, a leading eCommerce platform, reported double-digit growth in sales volume for January, both month-on-month and year-on-year. The company’s market cap reached a near-record high of 5.31 billion, surpassing competitor Television Broadcasts Limited (TVB).

HKTVmall’s success can be attributed to their effective social media strategy and community building efforts:

- Establishing the “R Squad” for surgical mask sourcing

- Sharing daily operation snapshots

- Introducing a new procurement officer recruitment scheme

These initiatives not only demonstrated their efforts to maintain supply stability but also fostered an inclusive community with their followers.

Watsons’ Successful eCommerce Transition

Watsons exemplified a successful transition from offline to online retail. They implemented three key strategies that resonated with netizens:

- Adopting “Fight Coronavirus Together” as their motto across digital platforms

- Conducting stress tests to ensure their eCommerce platform could handle unprecedented traffic

- Implementing real-name registration for online shoppers based on customer feedback

These efforts led to a significant increase in engagement on Watsons’ official Facebook page, with single-post engagement rates soaring from 50-100 to 5,000-12,000, a hundredfold increase.

Watsons’ new “mascot” assisted their online marketing campaigns being well received. The above is a captured post from Feb 16.

The Power of Social Listening and Online Reputation Management

The success of brands like HKTVmall and Watsons during this crisis highlights the importance of social listening and online reputation management. By effectively utilizing social media monitoring and analysis tools, these companies were able to adapt their strategies to meet consumer needs and build stronger relationships with their customers.

Conclusion: The Future of Retail in Hong Kong

As the retail landscape continues to evolve rapidly during this epidemic, brands must embrace digital transformation and eCommerce to survive and thrive. The ability to pivot quickly, address consumer concerns, and maintain a strong online presence will be crucial for success in the post-pandemic world.

By leveraging social media monitoring tools, sentiment analysis, and effective crisis management strategies, retailers can navigate these challenging times and emerge stronger on the other side. As we continue to monitor the situation, it’s clear that those who invest in their online presence and digital capabilities will be best positioned to weather the storm and meet the changing needs of Hong Kong consumers.