Hong Kong’s position as an international financial hub extends to the cryptocurrency sector, where it aims to play a significant role. However, the recent JPEX incident has highlighted the risks and challenges in this new domain, emphasizing the importance of social listening and market intelligence.

The JPEX Incident: A Case Study in Crisis Management

JPEX, a cryptocurrency trading platform operating in Hong Kong, recently came under scrutiny for several reasons. The company lacked an official license from the Securities and Futures Commission (SFC) of Hong Kong and falsely claimed to have secured a trading license in Dubai[1]. This incident has become a prime example of the need for effective crisis management in the digital age.

As of the latest reports, 15 arrests have been made in connection with this case, with 2,407 victims officially reporting the scam. The financial impact is estimated at a staggering HKD 1.5 billion.

Social Listening: Early Warning Signs on Social Media

The JPEX incident underscores the importance of social listening tools in identifying potential risks. Even before the situation escalated, vigilant netizens had raised warnings on social media platforms. This demonstrates how social media monitoring tools can serve as crucial early warning systems for businesses and investors alike.

Social Media Influencers and JPEX

Social media analytics revealed early co-mentions of several influencers with JPEX, dating back to 2021:

| Social Influencers | Date of First Co-Mention With JPEX |

|---|---|

| 幣少 | 2021-09-02 |

| Coingaroo | 2021-09-10 |

| 陳怡 | 2021-10-16 |

| 朱公子 | 2021-10-27 |

| Priscilla | 2021-12-06 |

| 亞洲區塊鏈協進會 | 2021-12-11 |

| TakeOne | 2021-12-11 |

| 高Sir | 2021-12-11 |

| YellowMan | 2021-12-11 |

| Hong Coin講幣 | 2021-12-11 |

| BlockDailyHK | 2021-12-11 |

This data highlights the potential of influencer marketing in cryptocurrency promotion and the need for careful vetting of partnerships.

Government Response and Market Intelligence

Secretary for Security, Tang Ping-keung, announced on September 27th that the government had initiated efforts to block JPEX’s website and app. He also noted a significant 52.2% year-on-year increase in fraudulent cases, representing 43.7% of all reported crimes[1]. This information serves as valuable market intelligence for businesses operating in the financial sector.

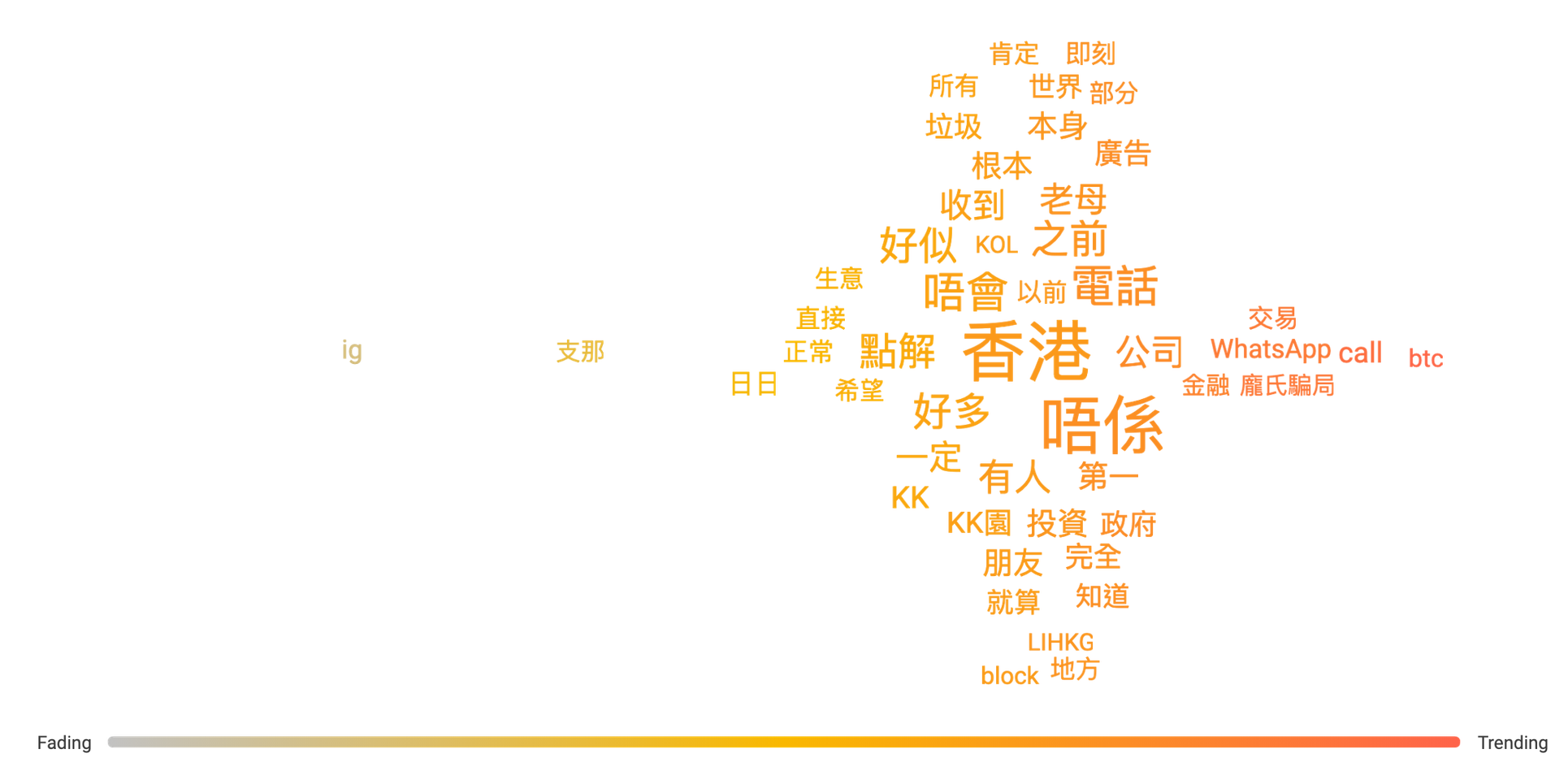

Figure 1: Word cloud highlighting the known JPEX Ponzi scheme with a new keyword ‘call’, catching attention | Source: TOCANAN

Emerging Scams and Consumer Behavior

Beyond the JPEX Ponzi scheme, new scam trends are emerging. Video call scams have gained attention, with fraudsters potentially recording faces and voices to gain unauthorized access to personal accounts. This shift in scammer tactics reflects changing consumer behavior in the digital age.

The Role of Social Media Monitoring in Brand Awareness

The JPEX incident demonstrates the critical role of social media monitoring in maintaining brand awareness and reputation. Companies can use social listening tools to:

- Detect potential crises early

- Monitor brand mentions and sentiment

- Identify emerging market trends

- Track competitor activities

Conclusion: The Importance of Digital Marketing Tools

Businesses must leverage advanced tools for social media monitoring, market intelligence, and crisis management. The JPEX incident serves as a stark reminder of the risks present in the cryptocurrency sector and the broader digital economy.

By employing robust social listening tools and maintaining a strong focus on market intelligence, companies can better protect their brand, identify potential risks, and capitalize on emerging opportunities. As Hong Kong continues to navigate its role in the global digital economy, these tools will become increasingly essential for businesses across all sectors.