Since his inauguration on October 20, 2024, Indonesia’s President Prabowo Subianto has navigated a whirlwind of policy implementations, fiscal reforms, and social program rollouts. This article discusses these key initiatives, showing how each policy announcement has influenced social media sentiment and institutional responses during his early months in office.

Chronological Policy Discussions

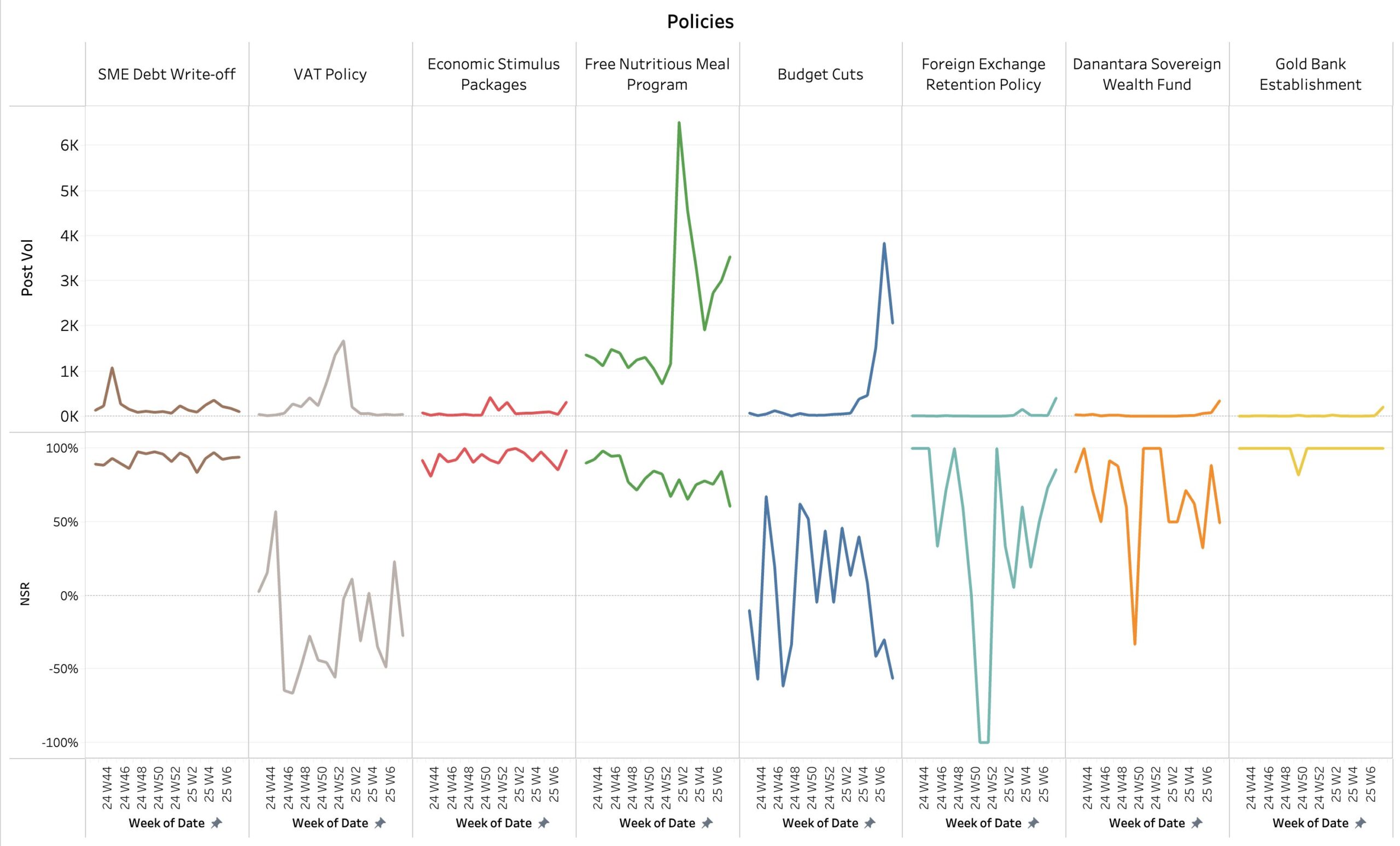

Figure 1: Social Media Discussion Volume and Sentiment Across Key Policies

November 2024 & January 2025: SME Debt Write-off for Certain Sectors & Progressive VAT Policy

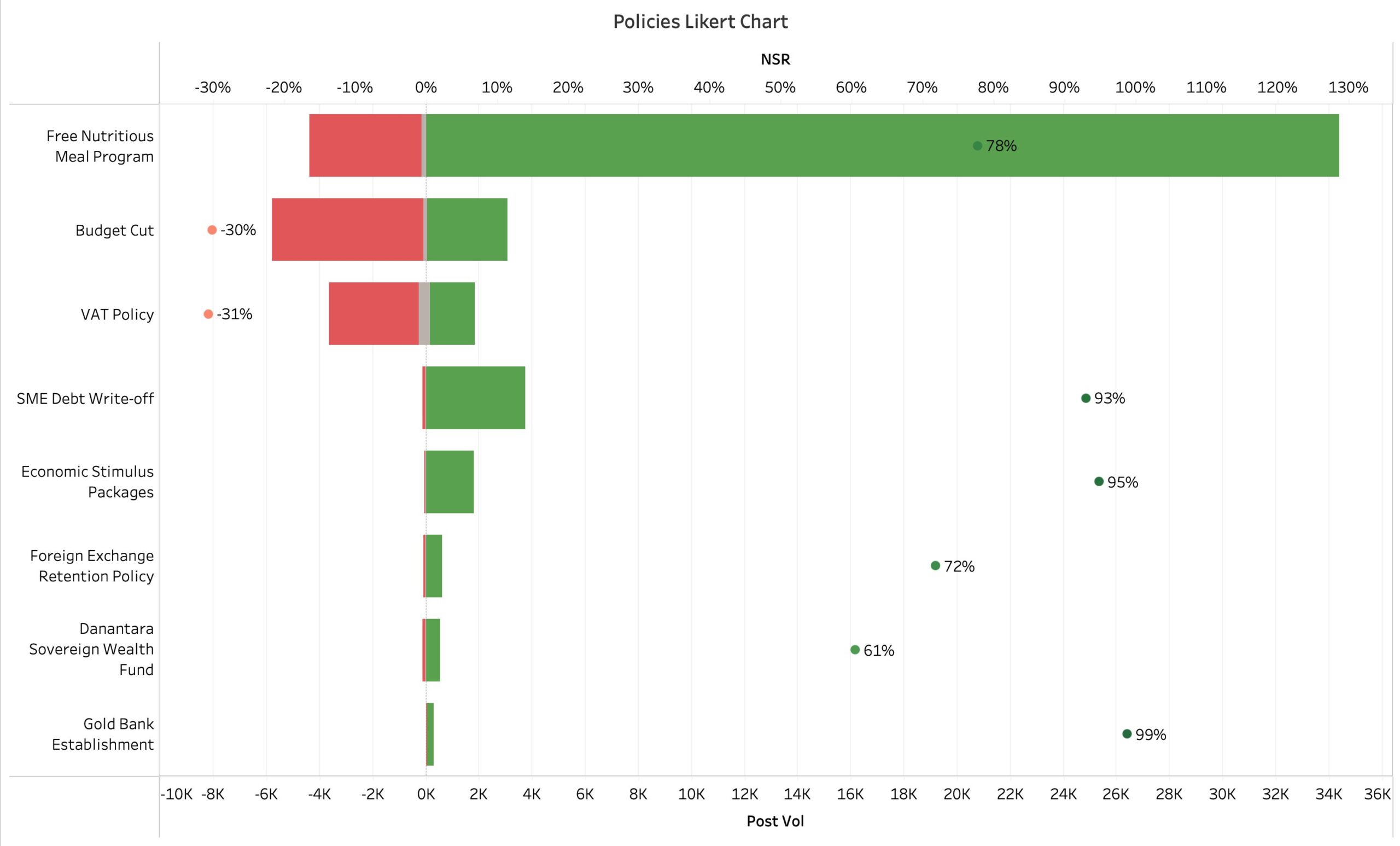

Prabowo’s debt write-off for SMEs in farming, fisheries, and plantations (up to Rp 500 million for businesses/Rp 300 million for individuals) garnered strong positive sentiment, particularly in Eastern Indonesia, where it was seen as a direct poverty alleviation measure. As from our collected social media data, online sentiment on platforms like Instagram showed a 75% positive response, with users sharing stories of debt relief and renewed business opportunities. The progressive VAT policy also received mixed reactions, with luxury consumers expressing discontent and middle-class consumers celebrating.

January 2025: Economic Stimulus Kick-off

While the luxury VAT implementation sparked minimal unrest, the Rp 38.6 trillion stimulus package earned significant approval. The stimulus includes:

- 10kg/month rice aid for 16M low-income families.

- 50% electricity discounts for 2,200 VA households.

- Tax exemptions for MSMEs with less than Rp 500M annual turnover.

Our analyzed data indicates that the rice distribution program was particularly popular, generating a 68% positive sentiment score on Facebook, with images of families receiving aid circulating widely. However, concerns about the package’s sustainability emerged on platforms like Reddit and Twitter, with users questioning long-term economic impacts.

January 2025: Free Nutritious Meal (MBG) Pilot Launch

The Free Nutritious Meal Program’s Initial phase cover:

- 570,000 students across 26 provinces.

- 190 kitchens operational, rising to 937 by January 2025.

Initial menus (fortified rice, tempeh, vegetables) cost Rp 15,000 ($0.91) per student daily. Social media sentiment turned cautiously optimistic:

- Positive: Mothers shared lunchbox photos with #AnakSehat hashtags

- Negative: Papuan students protested spoiled meals in viral TikTok clips

- Neutral: Nutritionists questioned protein adequacy (45g/day vs WHO’s 50g recommendation)

By February 15, the program exposed stark disparities: Jakarta achieved 89% coverage versus Papua’s 12% due to infrastructure gaps.

February 2025: Rp 750 Trillion Budget Cut

The administration’s controversial Presidential Instruction 1/2025 mandated 8% cuts across ministries, reallocating funds to MBG and Danantara. Sentiment analysis revealed three camps:

- Supporters: Praised “fiscal discipline” via X threads comparing Indonesia’s 2.9% deficit to Vietnam’s 4.1%.

- Neutral Observers: Noted Mahfud MD’s caution that “efisiensi bukan pangkas anggaran program berjalan” (efficiency isn’t cutting ongoing programs).

- Critics: Economists warn aggressive MBG funding (Rp 170T proposed) risks underfunding infrastructure and education.

Notably, majority of critical posts originated from Java’s student hubs, while Outer Islands focused on infrastructure delays.

February 2025: Foreign Exchange Retention Rule

Government Regulation 8/2025 mandated 100% forex retention for natural resource exporters, aiming to bolster rupiah stability. Sector reactions diverged:

- Nickel Miners: Backed the policy, with Harita Group CEO Lim Gunawan Hariyanto stating, “This protects against dollar volatility.”

- Palm Oil Giants: Warned of liquidity crunches; Musim Mas reported 22% cashflow dip in Q1 2025.

Reddit’s r/Finansial saw heated debates, with 61% users supporting nationalist measures but doubting Bank Indonesia’s absorption capacity.

Figure 2: Social Media Post Volume and Net Sentiment Rating (NSR) Distribution Across Policies (Likert Analysis)

February 2025: Danantara Sovereign Wealth Fund Launch

The $900 billion fund—Indonesia’s largest economic gambit—faced immediate turbulence:

- Investor Skepticism: Only 12 foreign firms attended the launch, wary of military-linked oversight boards.

- Public Distrust: #DanantaraWatch activists highlighted parallels to 1MDB, amassing 1.2 million TikTok views.

Despite Prabowo’s Norway-GPFG comparisons, leaked documents showed 67% initial allocations going to fossil fuel-linked SOEs versus 15% for renewables.

February 2025: Gold Bank Establishment

The state-owned gold bank aimed to leverage Indonesia’s 2,400-ton reserves (world’s #7) into monetary leverage. Early missteps plagued its debut:

- Pricing Issues: Farmers protested buying prices 14% below market rate.

- Digital Integration Failures: 43% branch apps crashed on launch day.

Yet, the policy found unlikely allies: Islamic scholars endorsed it as “syariah-compliant wealth management,” driving positive Facebook mentions.

Dominant Narratives Over Time

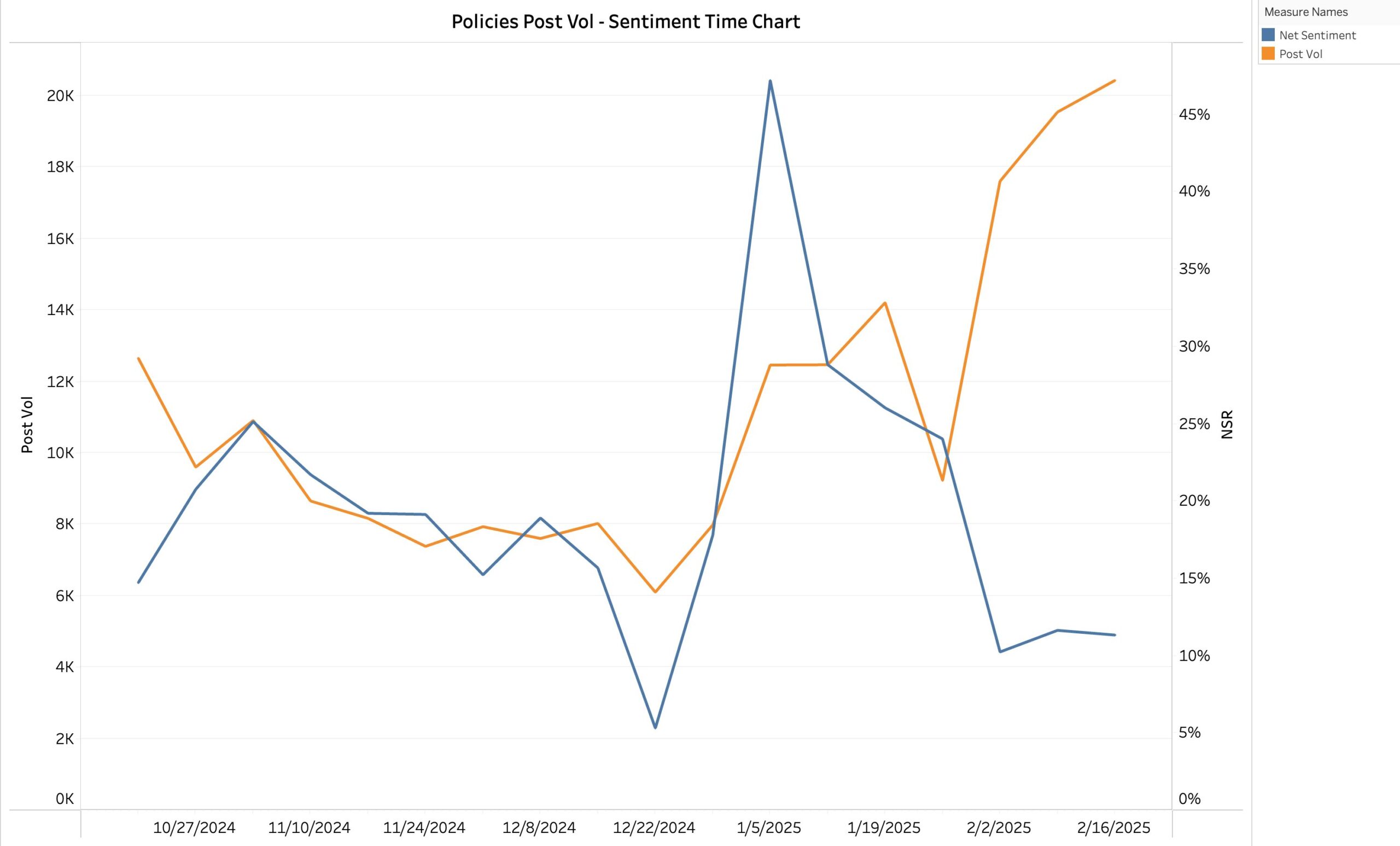

Evolving Populism (Oct 2024–Feb 2025)

Prabowo’s messaging shifted from technocratic reform (Nov VAT adjustments) to grand gestures (Feb gold bank), mirroring social media’s shortening attention spans.

Corruption Anxiety Peaks (Jan 2025)

The Rp 750 trillion cuts triggered #KorupsiEfisiensi hashtags after BPK found 17 municipalities misused reallocated funds. A Central Java case—where Rp 128 billion ($7.75 million) for MBG bought overpriced eggs—became February’s top Twitter topic.

Generational Solidarity Fractures (Feb 2025)

Youth initially embraced Prabowo’s digital outreach but soured over austerity:

- Gen Z (18-24): Approval dropped from 68% (Nov) to 49% (Feb) per Indikator Politik.

- Millennials (25-40): Held steady at 54%, valuing policy consistency.

Conclusion: The Chronology of Trust

Figure 3: Public Sentiment (NSR) Peaked in Early January Following the Launch of the Economic Stimulus and Free Nutritious Meal Policies, Then Declined Thereafter

Prabowo’s sequenced rollout—from quick populist wins (Nov debt relief) to complex structural reforms (Feb Danantara)—reveals a tactical approach to digital-era governance. However, each policy’s 14-day social media lifecycle underscores the administration’s central challenge: converting viral moments into sustained public confidence. With the gold bank’s rocky debut foreshadowing tougher reforms ahead, Prabowo’s next 100 days will test whether chronological coherence can compensate for implementation gaps in Indonesia’s real-time democracy.

Methodology: This analysis is based on 240K social media posts collected between October 2024, and February 2025, focusing on discussions related to Prabowo Subianto’s key policies. The dataset was analyzed using AI Advanced Natural Language Processing (NLP) Attribute-Sentiment analysis, leveraging a structured query to capture policy-related conversations across various platforms.